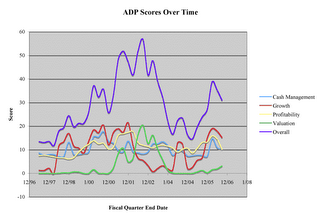

Using the results of the quarter ending 30 September 2006, ADP's scores were:

Cash Management:10

Growth: 15

Profitability: 10

Value: 3

Overall: 31

The first three scores are good, but the overall score is dragged down by the highly weighted (45 percent) Value score. This suggests that the company's solid financial performance is already reflected in the stock price.

We should note that ADP is one company where our analytical scores have a negative correlation with stock price gains. We might not be looking at the right parameters for this service company.

Let's look at the Valuation parameters more closely. An earlier post identified the components of our Value gauge as being Price/Earnings, Price/Earnings market premium, PEG ratio, and Price/Revenue.

ADP's P/E was 23.6 on 30 Sept, which is a small plus because the P/E is slightly below its 25.8 median value. The current P/E is a 51 percent premium relative to the S&P 500, which is a trivial amount below its 55 percent median premium. The PEG ratio is 2.1, which is too high to signal a value play. The current Price/Revenue is 2.9, which is not enough below its 3.2 median to get our attention.

No comments:

Post a Comment