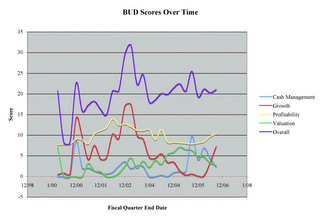

It was big news, back in the Spring of 2005, when Warren Buffet bought a large stake in Anheuser-Busch (BUD). We ran the numbers to determine if we could identify what led the Sage of Omaha to make this assessment. We couldn't: the numbers were lousy. So, we passed.

Mr Buffet recently cut his stake. What do the numbers look like now? They haven't improved a bit.

- Cash Management:2 (of 25)

- Growth: 7 (of 25)

- Profitability: 10 (of 25)

- Value: 3 (of 25)

- Overall: 21 (of 100)

Cash Management: The Current Ratio is less than 0.9. Long-Term Debt / Equity is a frightening 170%. Accounts Receivable/Revenues are up to 21.1 days from 19.8 days. One positive tidbit: Inventory is 23.7 days (relative to CGS), down from 26.8 days. We can't look at the proportion of Inventory allocated to Finished Goods because BUD has stopped reporting Inventory details in their 10-Q reports (too bad; it's a good indicator).

In a statistical oddity, Revenue Growth and CFO Growth are both a tepid 4.1%. Net Income Growth? A mere 1.0% -- it had been negative after previous quarters. Revenue/Assets has increased from 91.5 to 92.8 percent; a small step in the right direction

The Accrual Ratio is down, which is good, to 0% from 2.7%. The Return on Invested Capital was a reasonable 16 percent, but the company previously attained 20% returns. Free Cash Flow/Equity is an eye-popping 46% (but remember that debt, not equity, dominates the company's capital base). Operating Expenses/Revenues have been oh-so-slowly inching up (so much for cost control) and are now at 82%.

The PEG ratio is about 20 (we prefer somewhere around 1.0). Weak Net Income growth hasn't affected the Price/Earnings, which continues to hold around 19. Price/Revenue is down from 2.8 to 2.4. Remarkably, for a company with next to no growth, BUD commands a premium to the S&P 500.

We like their products. They're a better value than the stock. If you own the stock, you have a more compelling reason to consume the liquid version of BUD.

No comments:

Post a Comment